Final Expense Insurance or Burial Insurance is generally bought by the policyholder to make sure that their final expenses are paid for in case of their death. Even though these policies are known as Final Expense Insurance or Burial insurance, the policy used to fund the plan is a straightforward Whole Life Insurance contract. Here we will discuss final expense insurance and offer $8,000 final expense insurance quotes.

Whole Life insurance is the recommended policy type because it is offered with smaller death benefits, it will stay in force for the life of the policyholder, the premium never changes, and the underwriting required with the purchase is less rigorous. In fact, some insurance companies offer policies that are referred to as “guaranteed issue” and there is little to no medical details necessary.

Most of these insurance policies are generally purchased by individuals who are between age 50 and age 85 who either currently have no life insurance or desire to have a policy specifically for their final expenses (funeral and medical expenses) when they pass away. Buying a Final Expense Insurance policy is regarded as being an act of love because the insured is making preparations in advance of their death rather than leaving funeral arrangements and other expenses to their surviving loved ones.

Instructing Surviving Loved Ones

Many life insurance companies that provide final expense or burial insurance will usually provide a guide for the policyholder to use to present their last wishes for funeral preparations and how the death benefit ought to be utilized.

There may possibly be additional final expenses that will need to be paid as well. Lots of seniors that pass away may have spent some time in a nursing home or assisted living facility, so there may be a balance due to these types of facilities. As for other financial obligations, unless there is an adequate death benefit to deal with them, the debts will be satisfied by liquidating the insured’s assets in the estate.

Leaving behind instructions for your last wishes is the most appropriate means to take care of decisions regarding debts and funeral plans for your surviving loved ones. By planning in advance and buying final expense insurance or burial insurance, you help reduce the weight of decision making from the shoulders of your surviving loved ones who are usually grieving for you.

Is it Mandatory for a Beneficiary to use the Death Benefit for the Funeral?

Except in cases where the insured has assigned all or a portion of the death benefit to a funeral home or other organization, the beneficiary can spend the death benefit in any manner they choose. The insurer’s sole responsibility is to pay out the death benefit to the person or persons noted as beneficiaries on the insurance policy. If the beneficiary does not outlive the insured, the death benefit will be paid out to the contingent beneficiary or to the estate if there is no contingent listed.

The preferred way to make certain that your last wishes are carried out is by discussing your plans with the loved ones beforehand and make them aware that you would like them to take care of your funeral arrangements and that you have created a “last wishes directive” to help relieve them of the important decisions that will need to be made with regards to the funeral.

How much should I expect $8,000 Final Expense Quotes?

Unless the insured has made some preparations in advance, the beneficiary can expect to pay between $8,000 and $9,000 for a reasonably priced funeral. There are, however, other final expenses that can be related to the funeral service like a headstone instead of a marker and assisting relatives with transportation and accommodation expenses, but for now we are discussing $8,000 final expense quotes.

Regrettably, funeral expenses are climbing and unless they are organized in advance, your loved ones might possibly get taken advantage of due to the fact that most people are reluctant to negotiate while mourning the loss of their loved one.

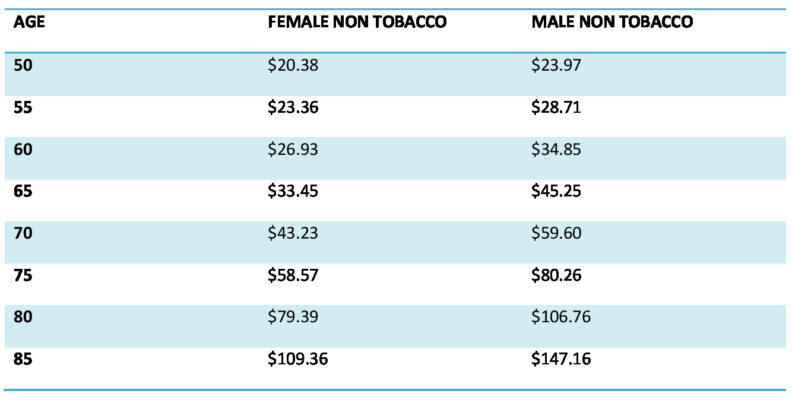

Actual $8,000 Final Expense Quotes

Below, we have listed actual $8,000 final expense insurance quotes by age groups between 50 and 85 years-old. For a quote for your current age, please use the form on the right of this page. We have listed the assumptions for these quotes below:

- Rates are based on non-smokers. Those who smoke will pay a lot more insurance premiums.

- The monthly rates are determined by your age group. For a quote based on your exact age, simply fill out our instant quote form.

- We represent many highly-rated life insurance companies but feel this selection will provide an accurate picture of the premium you can expect to pay.

These $8,000 final expense quotes are based on level benefits and first-day coverage as long as the applicant’s answers to the health questions do not disqualify them from coverage.

What if I’m Declined?

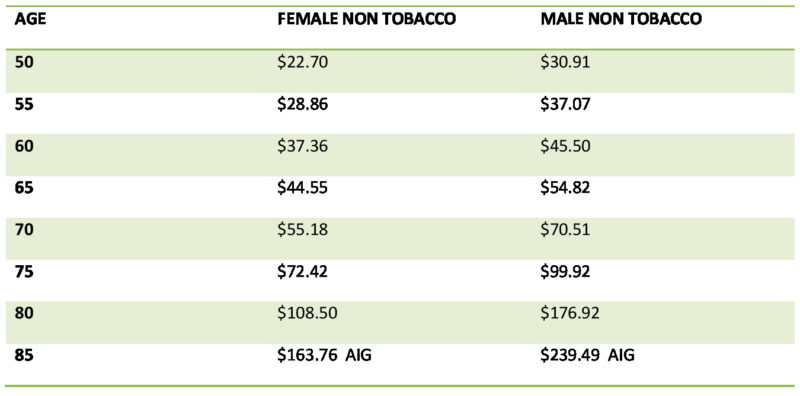

If you are declined as a result of your answers to the medical or lifestyle questions, Docktor’s Insurance will recommend a “guaranteed issue” policy that contains no health questions and doesn’t require a medical exam. Listed below are our best rates for guaranteed issue life insurance:

It’s important to note that guaranteed issue coverage has a waiting period of two or three years when the insurer will not pay the full death benefit for death from natural causes. The insurer will, however, pay the full benefit from day one if death is the result of an accident.