Certainly, we can agree that one of the most challenging experiences that an individual must deal with is the passing away of family member or friend. Additionally, many surviving friends and loved ones are left behind to manage and sometimes pay for the end-of-life medical expenses and the sometimes staggering costs of the funeral and burial. All of this is added to the burden of stress and mourning that accompanies the loved one’s passing. We know that life insurance is commonly available to take care of the expenses but final wishes may not always be provided by the deceased. Here we will discuss final expense insurance and how it can resolve the financial issues associated with dying.

For those men and women who may have put-off or even overlooked purchasing a life insurance policy when they were young and healthy, Final Expense insurance is available for those who may be declined when applying for inexpensive fully-underwritten life insurance. Final expense insurance provides a less challenging way for older and less-healthy men and women to purchase life insurance without the need for a medical exam of blood and urine test.

In fact, if your answers to the health questions on the application prevent you from being approved for coverage, most companies will offer a “guaranteed issue” policy where health conditions and questions are disregarded.

Addressing the Increased Cost of Dying

Reports and data are readily available from various funeral home associations that the cost of dying has increased about 1300 percent over the previous three to four decades, and the cost of traditional funerals and gravesites are expected to rise even more. Currently, the cost of a traditional and moderately priced funeral is about $10,000 without including the cost of the g

A Logical and Necessary Insurance Solution

The most inexpensive traditional life insurance products like Term insurance and Universal Life are typically purchased to replace the lost income when a family breadwinner passes away. These policies generally have a substantial death benefit to accommodate a family’s accumulated debt, a significant mortgage balance, and monthly expenses into the future. They are larger and affordable policies because the insureds are younger and healthier.

But when we have gotten older, however, the need for a large amount of insurance is reduced because through the years, debts have been paid and we own the home we live in. This is a good thing since because of our age and health, traditional life insurance is likely to be unattainable, and certainly, temporary insurance like Term may likely be a waste of money since we can easily outlive the policy period.

In this time of our life purchasing a final expense insurance policy is the most practical solution for seniors looking to shield their surviving family and friends from continually increasing funeral costs. Final expense insurance is generally easy to qualify for since the policy is considered according to your answers to health questions, and in most cases, there is no medical exam.

How Much is this Final Expense Insurance Going to Cost?

In most cases, you can cover the majority cost of a funeral with a $9,000 death benefit if your beneficiary takes a very frugal approach to planning the funeral.

When you contact an independent agent like Docktor’s Insurance, you will have the ability to shop all of the leading final expense insurance companies at once. You can do this on our website or by calling the office during normal business hours.

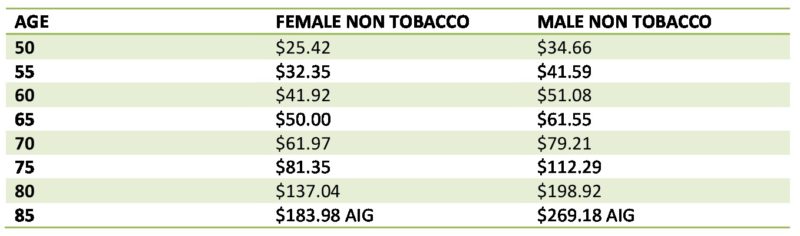

Our Best Rates for $9,000 Final Expense Quotes

When you review the information below, you will find actual rates from a highly-rated life insurer that offers Final Expense Insurance. We have also provided several common assumptions. For a quote on a particular age, you can use the instant quote form on the right of this page.

- Rates are based on non-smokers. Those who smoke will pay a lot more insurance premiums.

- The monthly rates are determined by your age group. For a quote based on your exact age, simply fill out our instant quote form.

- We represent many highly-rated life insurance companies but feel this selection will provide an accurate picture of the premium you can expect to pay.

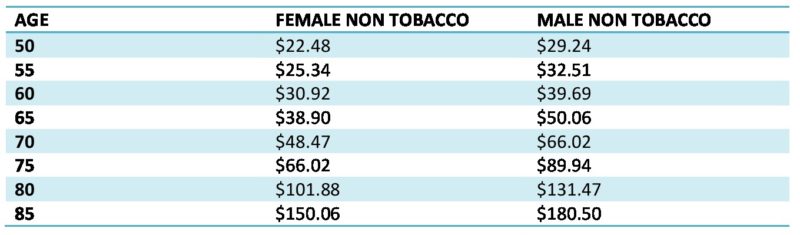

Are there Options if I’m Declined?

Yes, there are. If you are declined as a result of your answers to the medical or lifestyle questions, Docktor’s Insurance will recommend a “guaranteed issue” policy that contains no health questions and doesn’t require a medical exam. Below are our best rates.

$9,000 Final Expense Quotes