If you are thinking about buying either Final Expense Insurance or Burial Insurance, choosing the best insurance company may appear to be a challenge. In most cases, the same questions come up from virtually everyone who is contemplating a purchase.

- Will I qualify for coverage?

- Is the insurer reputable?

- Does the company pay their claims quickly?

- Am I Getting a Competitive Rate?

Each of these are relevant, popular, and practical questions, and would probably come to anyone’s mind because of the type of the partnership. Going into an insurance contract is very significant, and every question should be resolved prior to rather than after your policy is issued.

If you are like many people and discover insurance policies are challenging to read and understand, it makes really good sense to have a knowledgeable independent agent in your corner who is going to look out for your best interests throughout your insurance transaction. The following are frequently asked questions that you ought to know the answer to so you can be secure in your purchase.

Will I Qualify for Coverage?

Since none of our final expense insurance plans require a medical exam, your answers to the health questions on the application whether you are qualified for coverage. If you do not qualify for standard Final Expense Insurance coverage, we will get you qualified for a guaranteed issue policy since there are no health questions or medical exams required.

Is the Insurer Reputable?

You certainly want to be confident that your insurer is well prepared to pay the claim when the most unfortunate thing happens. It makes excellent sense to make sure that the insurer is financially stable and reputable before you agree to a purchase.

The good news is, potential customers have access to a well-known insurance company rating service called A. M. Best, and your internet search will offer the financial information about any life insurance company you are considering. The A. M. Best web portal may ask you to register, but there is no charge to obtain their data. In fact, there are many other consumer resource tools available on their web pages. To access this beneficial tool, click here. Additionally, most reputable independent agents can email you a list of the carriers they represent with each company’s A.M. Best rating listed next to the company’s name.

Does the Company Pay their Claims Quickly?

When it finally comes time for the insurer to pay a death benefit on your Final Expense Insurance or Burial Insurance, you definitely want to be guaranteed that the death benefit is paid promptly and appropriately. Funeral and burial expenses need to be taken care of in a matter of days, not weeks, and you have every right to be concerned that your beneficiary receives a prompt payout from the carrier.

The more effective agents take the required steps to monitor claim payments for their clientele. If they represent a carrier that is not getting claim payments out in an acceptable amount of time, they are usually the first to know about it. It is reasonable that a reputable independent agent would cease representing an insurance company whose claims service is causing telephone calls from disappointed beneficiaries, surviving loved ones, and funeral directors.

Am I Getting a Competitive Rate?

The answer to this question is much more about your independent agent’s capability to search all leading insurance companies on your behalf. When you are thinking about Final Expense Insurance or Burial Insurance, you are much better served by using a trustworthy and knowledgeable independent agent. The majority of independent agents represent all of the important players in the insurance market, and you can confirm this when you make the first contact. Using an independent agent works well in your favor because the agents will continually put your needs first throughout the shopping, underwriting, and purchasing process.

Presently, there are about 750 life insurance companies in the U.S., but only about 10 percent of these offer Final Expense Insurance and Burial Insurance. Your independent agent should represent the majority of these carriers or at least the top twenty as far as rates and available products are concerned.

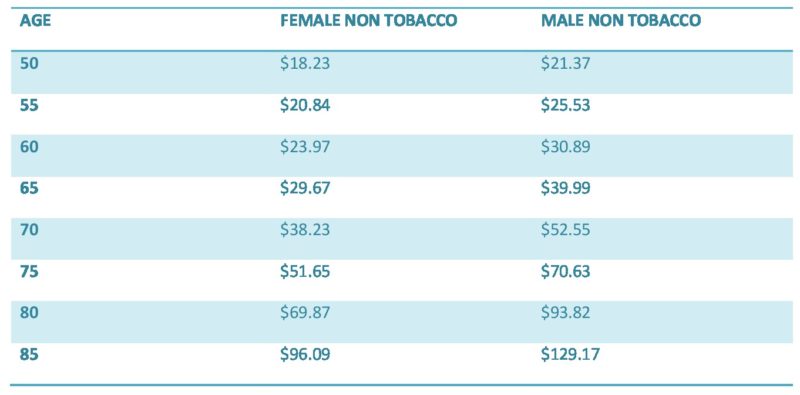

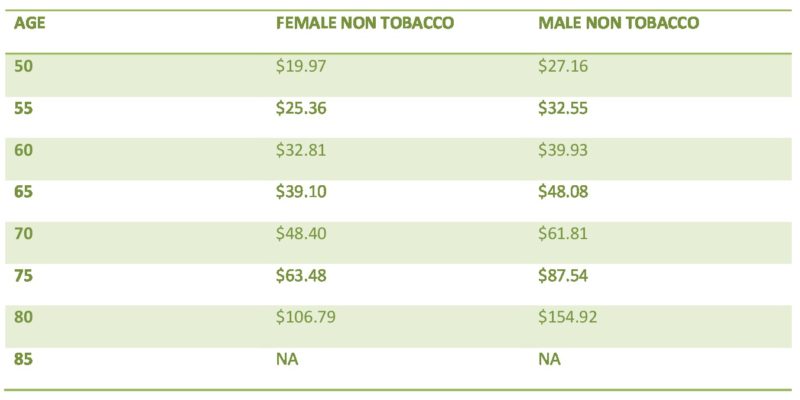

Here are Our $7,000 Final Expense Quotes

Below are actual quotes for $7,000 Final Expense Insurance quotes.

When you review the information below, you will find actual rates from a highly-rated life insurer that offers Final Expense Insurance. We have also provided several assumptions:

- Rates are based on non-smokers. Those who smoke will pay a lot more insurance premiums.

- The monthly rates are determined by your age group. For a quote based on your exact age, simply fill out our instant quote form.

- We represent many highly-rated life insurance companies but feel this selection will provide an accurate picture of the premium you can expect to pay.

As you can see by the rate chart above for $7,000 Final Expense quotes, women cost less to insure than men. This is simply because women tend to live longer than men which will allow the insurance company to spread the cost of insurance over a longer time period.

For more information about $7,000 Final Expense Insurance quotes or any other amount of final expense insurance, call the professionals at Docktor’s Insurance at (888) 773-1181 during normal business hours, or you can contact us through our website at your convenience.