Final expense insurance not only helps surviving loved ones to pay for final expenses like funeral and burial costs, it also will provide peace of mind to the policyholder knowing they’ve taken care of expenses that will be passed on to family members. Here, we’ll discuss $14,000 final expense quotes.

No one likes to think about their eventual death much less make preparations for the associated costs in advance. But certainly, no one wants to leave their final expenses for family members to deal with while they are mourning their loss.

Unfortunately, funerals have become very expensive and recent reports are indicating that prices will continue to rise in the years ahead. Currently, an average priced funeral and burial costs about $8,000 to $12,000 which is a significant amount of money for surviving family members to come up with. This alone is a solid reason that final expense insurance should be considered right now and not later.

By planning ahead, we can easily fund the final expenses that are associated with our passing like funeral expenses, nursing home costs, and unpaid medical bills.

What is Final Expense Insurance Exactly?

Final expense insurance, also referred to as burial or funeral insurance, is a whole life insurance policy designated to pay for all final expenses a policyholder leaves when they pass away.

By using whole life insurance, the policyholder receives all the guarantees and benefits that whole life insurance provides:

- Guaranteed insurance coverage for a lifetime as long as the premium is paid.

- Guaranteed monthly premiums that will not change, even when you get older, become ill, or have to live in a nursing home.

- Your policy will build cash value over time that can be accessed using policy loans or withdrawals.

Is a Medical Exam Required?

In almost every case, no medical exam is required to purchase final expense insurance. There are, however, many health questions on the application that you must answer truthfully. In situations when an applicant is denied coverage because of their answers to the health questions, a guaranteed issue insurance policy will be offered. This means that any applicant can purchase final expense insurance as long as their age falls within the eligible age groups which are generally 50 to 85-years old.

Does it Cost More Than Traditional Life Insurance?

Since final expense policies are not fully-underwritten like traditional life insurance policies, they do cost more because the insurer is taking on a higher risk. You can, however, by smaller policies that you feel with be enough to cover only certain expenses for your loved ones.

One of the better benefits you’ll find when purchasing final expense insurance is that most insurance brokers offer a free quote engine on their website that will offer rates from all of the highly-rated insurance companies. It’s surprisingly simple to fill out one very short form and then be offered insurance rates from more than a dozen insurance companies.

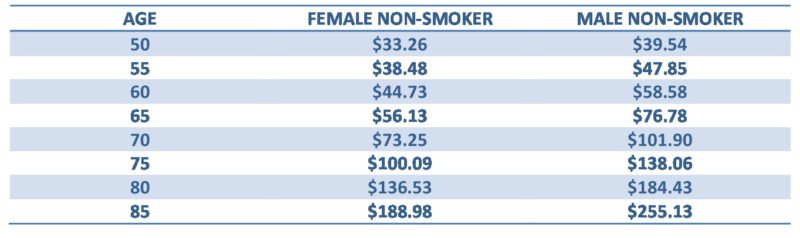

Here is an example of $14,000 Final Expense Quotes for a Male and Female non-smoker:

If you noticed that insurance rates for a male are higher than those for a female, this is because women typically outlive men and that gives the insurer more time to collect premiums. For an accurate for your actual age, please use our quote engine on the right side of this page.

What Happens if I Don’t Qualify?

If you are unfortunate enough not to qualify for our level insurance benefit plans, don’t despair. As an independent insurance agency that represents multiple insurance companies, we are able to offer “guaranteed issue” life insurance. The guaranteed issue policies do not take any health issues into consideration and virtually anyone between 50 and 85 will qualify for coverage.

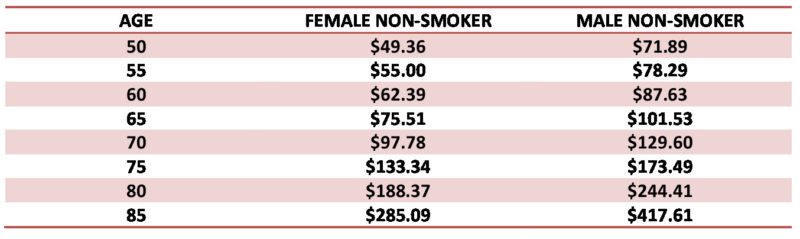

Here is an example of $14,000 final expense quotes for guaranteed issue life insurance:

Since this type of insurance policy is issued without consideration for your health, the insurer will apply a two-year waiting period during which the company will not pay the full death benefit if the insured dies as a result of natural causes. The company will, however, return all of the premiums paid plus an additional percentage to the beneficiary.

If the insured’s death is the result of an accident, the beneficiary will receive the full death benefit beginning the first day of coverage.