Final Expense Insurance or Burial Insurance is typically obtained by individuals who want to make sure their final expenses are covered in case of their death. instead of leaving these expenses to surviving loved ones. These policies, also known as funeral insurance, are a great solution for leaving the funds required for various final expenses such as funeral costs, unpaid nursing home expenses, and unpaid medical bills.

Whole Life insurance is the preferred type of insurance policy because it can be purchased with lower death benefits, it will remain in force for the life of the insured, the premium will never change, and the underwriting required is less rigorous. In fact, some life insurance companies offer policies that are “guaranteed issue” and there is little to no medical details necessary.

The vast majority of these final expense policies are purchased by individuals who are between 50 and 85-years old and who either have no life insurance or want to have life insurance exclusively for their final expenses (funeral and medical expenses) when they pass away.

Getting a Final Expense Insurance policy is considered an act of love given that the policyholder is making arrangements in advance of their death instead of leaving funeral arrangements and other expenses to their surviving loved ones who are mourning their loss.

Does My Beneficiary Have to Use the Death Benefit for Final Expenses?

Unless you as the policy owner have assigned part or all of the death benefit to a funeral home or other organization, your beneficiary can spend the death benefit on anything they want to spend it on. The insurance carrier’s only responsibility is to pay out the death benefit to the person, persons, or entity designated as beneficiaries on the insurance policy. If the beneficiary does not survive the policyholder and there are no contingent beneficiaries, the death benefit will be paid to the estate of the insured and becomes subject to probate.

The recommended strategy to make sure that your wishes are carried out upon your death is by talking about your final wishes with loved ones ahead of time to let them know that you want them to take care of your funeral arrangements and that you have prepared a “last wishes directive” to relieve them of the vital decisions that will have to be considered about your funeral and other final expenses.

What if My Beneficiary Dies Before I Die?

Unfortunately, it is not uncommon for a beneficiary to die before a policyholder. It’s even more unfortunate that quite often the deceased beneficiary is not replaced on the policy or that a contingent beneficiary was not named in the contract.

An experienced and reputable insurance broker should make certain that every policyholder names a contingent beneficiary when the policy is issued and make contact with their insurance clients at least once a year to determine if there are any changes needed regarding the beneficiary or contingent beneficiary listed on the policy. In any case, policyholders should be aware that it is their responsibility to notify the agent or the insurance company when there are important changes that need to be made on their insurance policy.

How much does Final Expense Insurance Cost?

All life insurance policies are rated primarily based on the age and health of the applicant. Even when a medical exam is not required, there will be health questions on the application that will affect your health class which affects the rate you’ll pay for insurance.

It’s also important to note that insurance companies set their rates and underwriting guidelines differently so it is important to get rates from as many carriers as possible. Where one carrier may have high rates for a particular medical condition, another carrier can offers lower rates for that very same condition.

Fortunately, with today’s technology, life insurance shoppers can typically get instant quotes on an independent agent’s website and get a pretty clear picture of how much they can expect to pay for coverage. It is, however, very important that you understand that life insurance rates are never final until the underwriting is completed.

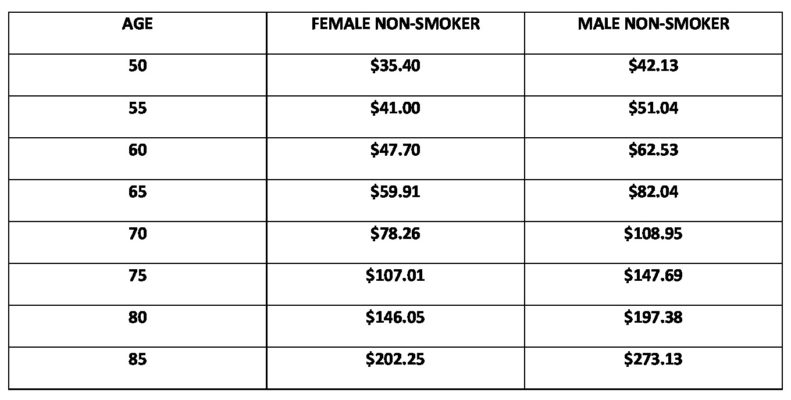

Actual $15,000 Final Expense Quotes

Below, you will find $15,000 final expense quotes for a male and female non-smoker:

![]()

A $15,000 death benefit is fairly typical for Final Expense Insurance because the benefit is generally sufficient to cover a moderately priced funeral ($8,000 to $12,000) and the balance can be used for lingering medical or nursing home expenses. It’s also important to note that although the insurance company will likely not require a medical exam, some medical conditions can result in the carrier declining to offer coverage.

I was Declined, Now What?

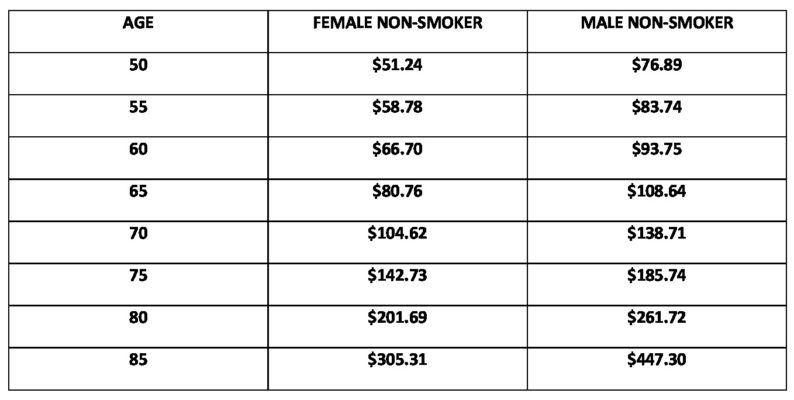

If your application was declined because of health issues, your independent agent can offer a guaranteed issue insurance policy. A guaranteed issue policy, although more expensive than traditional insurance, does not take health issues into consideration during the underwriting process. This means that you will be able to purchase life insurance as long as you are in the eligible age groups.

Below, please find $15,000 Final Expense Quotes for Guaranteed Issue Life Insurance:

The Bottom Line

After reviewing the rate charts shown above, it is certainly glaringly apparent that your life insurance costs will never be lower than they are today. The earlier that you buy your final expense insurance policy, the less you will have to pay for it.

888-773-1181 during normal business hours, or contact us through our website at your convenience.