In today’s economy, advertisers will typically target different groups of consumers based on the age group they intend to sell a product or service to. Baby boomers are especially targeted for different products or services that related to their age group and their buying power. One of the most popular products or services is life insurance and in particular, final expense life insurance. In this article, we’ll discuss final expense life insurance, what it’s used for, and it’s features and benefits. We’ll also take a look at $16,000 final expense quotes.

What’s It Used For?

We know from research from various companies that survey funeral directors across America that a moderately priced funeral and burial is going to cost in the neighborhood of $8,000 to $12,000 depending on the state and area you live in. For those who choose cremation over a traditional burial, cremation costs are commonly about half.

There are also other final expenses that may need to be dealt with so that they will not pass on to surviving loved ones or transferred to the estate of the deceased:

Nursing Home

A lot of seniors are likely to spend time in a nursing home before passing and there are likely to be lingering expenses that result from deductibles and copays that should be dealt with.

Medical Expenses

Unless the deceased had Medicare Supplement insurance, there will typically be outstanding health care expenses that have not been paid as well.

Unforeseen Funeral Expenses

Just like with any other major project, funeral expenses are rarely etched in stone. In a lot of cases, family members who are living out of state and must travel at short notice might need some financial help with travel and hotel accommodations.

Other Outstanding Debts

Although individual personal debt is rarely passed on to surviving loved ones, in cases where a spouse or other family member may have acted as a guarantor, that debt will need to be paid so the guarantor party does not become responsible.

Features and Benefits of Final Expense Insurance

Since a final expense policy is typically written as whole life insurance, there are certain guarantees and benefits provided that are important to understand.

Feature and Benefit

A whole life insurance policy will remain in force for the lifetime of the policyholder as long as the premiums are paid which benefits the policyholder by providing peace of mind knowing that the policy will be there when it’s most needed.

Feature and Benefit

With whole life insurance, once your policy has been issued, the premium can never be increased by the insurer, even if you become seriously ill or have to spend the rest of your life in a nursing home. With whole life final expense insurance, policyholders know their premium will never change.

Feature and Benefit

Since your final expense insurance is whole life, the policy contains a cash value component that will grow over time and earn a guaranteed interest rate that is tax-deferred for the policyholder. This cash value account provides the benefit of being able to access that cash if you have a financial need through policy loans or withdrawals.

Feature and Benefit

Shortly after you pass away, your beneficiary will receive the death benefit in a lump sum payment that will be tax-free and since these proceeds are tax-free, the policyholder will have peace of mind knowing that they are not passing along a tax liability related to the death benefit.

How Much Does Final Expense Insurance Cost?

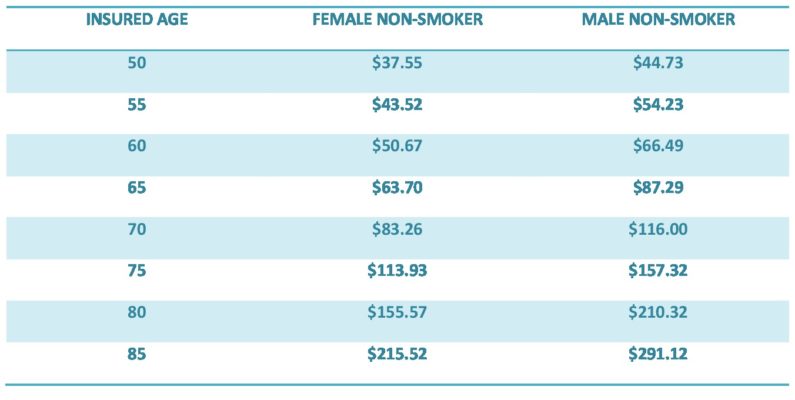

Here are our actual $16,000 Final Expense Quotes for a Level Benefit Policy:

![]()

To get an accurate quote for your actual age, please use our instant quoter on the right side of the page.

What if I don’t Qualify?

Even if you don’t qualify for a level benefit policy that provides first-day coverage, you can qualify for a “guaranteed issue” policy. With a guaranteed issue final expense policy, the insurance company does not consider your medical condition in order to issue a policy. Virtually anyone can buy guaranteed issue life insurance as long as they are within the age limits set by the insurance company.

With guaranteed issue life insurance, there is typically a two or three-year waiting period before the insurer will pay the full death benefit if you die from natural causes, but if your death the result of an accident, the company pays the full death benefit from the first day.

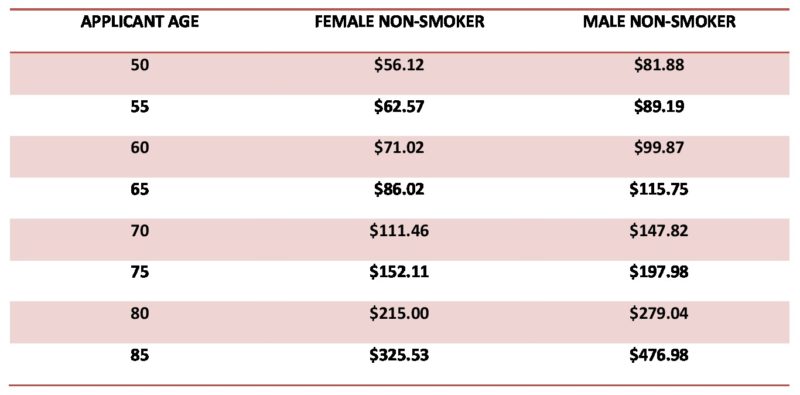

Here are our actual $16,000 Final Expense Quotes for a Guaranteed Issue Policy

As you’ve likely noticed, guaranteed issue life insurance costs substantially more than level benefit life insurance because since there are no health considerations, the insurer is accepting an unknown risk.