Share the post "Short-Term Health Insurance in Florida"

Health insurance and healthcare is a genuine concern for almost every adult in the U.S., especially with the continual fight between Democrats and Republicans in Congress.

Whether you’re a fan of the Affordable Care Act (Obama Care) or prefer purchasing insurance in the private marketplace, your choices may become more limited in 2019. Since the government was able to strike down the “mandatory coverage provision” of the ACA, the bottom could easily fall out and when that happens, America will likely see health insurers running for the hills while their profits have a race to the bottom.

If you’ve been watching the news at all lately you’ve probably heard a little about short-term health insurance and how it could be a solution for consumers who are not as concerned about coverage with pre-existing conditions. Here, we’ll dig into Short-Term Health Insurance in Florida and discuss why it could possibly be as good as or better than ACA insurance (Obama Care) depending on your individual circumstances.

What is Short-Term Health Insurance?

Originally, short-term health insurance was designed for healthy people who found themselves in a health insurance coverage gap or who were looking to get health insurance while in between jobs. These short-term policies were perfect for providing coverage while Americans were dealing with various life events like:

- You’ve lost your job and can’t afford the COBRA premiums

- You have graduated from college recently and need coverage until you become employed

- You’ve recently been through a divorce and you cannot stay on your spouse’s health plan

- You’ve retired early and cannot enroll in Medicare for a year or two

Although most short-term health plans were designed to offer coverage for only three months, in many cases you were allowed to renew your coverage at least one or two times. More importantly, short-term health insurance does not cover pre-existing conditions, preventive care or issues like maternity or mental health care. The difference in the ACA coverage and short-term health coverage is huge but so are the premiums.

Before, when the ACA was mandatory and all health insurance policies had to contain the mandated “essential coverages,” a short-term health plan would not meet the essential coverage provision so as far as the ACA was concerned, a policyholder was covered enough to escape the mandatory coverage penalty; now, all that has changed.

The Difference between Short-Term Health Insurance and ACA Insurance

Certainly, it’s only fair to point out the coverage differences between short-term health insurance and the Affordable Care Act insurance plans. The chart listed below makes the distinctions very apparent:

| Short-Term Health Insurance | ACA Health Insurance | |

| Length of Coverage | 30 days up to 12 months | Annual policy period |

| ACA Compliant? | No. Short-term health insurance plans are not required to comply with ACA requirements | Yes. The ACA requires all insurance plans to offer the 10 Essential Health benefits and cover at least 60% of medical expenses. |

| Cost of Insurance | Varies depending on the coverage you select along with the deductibles and coinsurance, but typically much less than regular health insurance. | Varies depending on the plan you select and any subsidies you qualify for. Available plans will offer 60, 70, and 80% coverage and are priced higher than short-term health plans. |

| Eligibility | Applicants with certain pre-existing health conditions may not qualify for coverage. | The ACA accepts all applicants for health insurance coverage. |

| Is coverage renewable? | Under the new rules, policy periods can be up to a year with renewals for 36 months | Renewable each year. |

| Preventative Care Available? | Optional depending on the carrier | Yes. One of the 10 Essential Benefits |

| Pre-Existing conditions allowed? | Usually excluded or denied | Yes |

| Maternity Coverage? | Not covered | Covered |

| Mental Health Coverage | Not covered | Covered |

This chart lists the differences between most short-term health insurance plans and the ACA plan. Although the federal government has a lot of oversight, each state will also have some oversight. Because of this, some short-term health plans may be more comprehensive depending on the company you select and the state you live in.

The Pros and Cons of ACA Health Insurance

With any insurance product we purchase, it’s likely that the pros and cons will differ among policyholders based on their individual circumstances. Here are the most prominent pros and cons

Pros of Obamacare (ACA)

- Comprehensive health coverage. ACA plans must provide the 10 Essential Benefits that were established by the government and must cover at least 60% of medical costs.

- Provides Coverage for Pre-Existing Conditions. Probably one of the most popular advantages and a major reason for its creations, the ACA health plans cannot deny coverage or charge higher rates for applicants with pre-existing conditions.

- No coverage limits. Before the ACA, most insurance carriers placed a lifetime coverage limit on policies for individuals. Those limits have been eliminated.

- Allowed children on a parents’ plan up to age 26. This must have been another important coverage for families because after the rule was enacted, over three million young adults were added to their parents’ health insurance policy.

- It created funding for premium subsidies to low-income applicants. Millions of Americans receive subsidies to help with their cost of insurance as long as they do not qualify for employer-sponsored or union-sponsored health insurance.

- Coverage for preventive health care. In an effort to reduce the number of policyholders using their health insurance for illnesses that result from preventable issues, the ACA mandated health insurers to pay 100% for preventive health care like annual checkups and various diagnostic testing.

Cons of Obamacare (ACA)

- High Cost for Coverage. For many individuals and families, if they did not qualify for subsidies, they simply could not afford the cost of Obamacare and continued to remain uninsured even though they were subject to financial penalties.

- Tax Penalty for non-participation. If an individual or family elected not to participate and failed to purchase an insurance plan and didn’t qualify for an exemption, they were required to pay a tax penalty of 2.5% of their annual income. (This rule has been recently rescinded by the new administration)

- Mandated coverage for unneeded services. The ACA mandated essential benefits that were unneeded by policyholders such as maternity coverage for men. Even women who were unable to conceive or go through childbirth were still required to have this coverage.

- Because of the ACA, excise taxes were levied on medical device manufacturers and importers. Additionally, another tax of 10% was levied on businesses that provided tanning services.

- Required Pharmaceutical Companies to pay fees. Although these fees were designed to help with federal governments cost of the ACA, the pharmaceutical companies simply passed the additional fees on to consumers.

- Required businesses to provide insurance coverage to employees working 30 or more hours per week. This additional cost to employers was mitigated by employers reducing the number of employees and reducing the hours of many employees to fewer than 30 hours per week.

The Pros and Cons of Short-Term Health Insurance in Florida

Although the pros and cons of short-term health insurance depend on the company you select and the plans that are available, most short-term health plans share various pros and cons.

Short-Term Health Insurance Pros

- Instant Issue – Most insurance companies that offer short-term health insurance provide policies with simple underwriting and instant issue.

- Affordable Plan Premiums – Short-Term insurance policies generally cost much less than ACA policies because the insurers are not required to accept all applicants. This means that healthy policyholders do not have to share in the cost of unhealthy policyholders.

- Fill in coverage gaps – Short-term insurance policies can easily fill in the coverage gap that typically results when an individual is between jobs.

- Large Provider Networks – Most insurance companies that offer short-term insurance coverage have a very large network of healthcare providers so finding a physician or specialist is much easier that ACA carriers who use a smaller network of physicians and hospitals. For example, UnitedHealthCare’s Short-Term Health plans have a national network that policyholders can access with over 1.2 million physicians and about 6,500 hospitals and other outpatient facilities.

- Renewable up to 36 months – Because of the recent Rule Change, Short-Term health plans are now available with annual terms that can be renewed for up to 36 months.

- Referrals Not Required – Since most short-term health plans do not require a primary physician selection by the policyholder, a referral is not required to see a specialist.

Cons of Short-Term Health Insurance

- Policies are medically underwritten. Since short-term health plans are medically underwritten, applicants could be subject to coverage exclusions or declined due to pre-existing conditions.

- Fewer Coverages Available – Since short-term health insurance is not subject to ACA mandatory coverages, medical services like maternity benefits, preventive care, and mental illness and substance abuse treatment may not be covered.

- Coverage Limits – Short-Term health plans typically have a policy limit on payments from the insurer and do not have a limit on out-of-pocket expenses paid by the policyholder.

- Removes eligibility for COBRA – Consumers who enroll in a short-term health insurance policy cannot elect to participate in COBRA once their short-term coverage is exhausted.

- Age Eligibility – Most short-term health plans will not accept applicants age 65 or older.

- Limitations on Renewals – With the recent Rule Change implemented by the Whitehouse, the maximum amount of plan renewal is 36 months.

- No Premium Subsidies – Because short-term health insurance is not part of the ACA, there are no subsidies available for low-income individuals and families.

Why Should You Consider Short-Term Insurance Plans in Florida?

Short-Term health insurance plans are not the best solution for everybody but they can be the best solution if you are:

- Looking for an alternative to expensive ACA or COBRA coverage

- Aging out of your parents’ health insurance

- Leaving one job for another and expect a lapse in health insurance coverage

- Without health insurance, have missed your Open Enrollment Period and you don’t have a qualifying event for Special Enrollment

- waiting for an ACA or another insurance plan to begin and are currently without coverage

- A college student or will be graduating soon and losing your health insurance

- Recently employed and your employer has a waiting period for their group health benefits to begin

- Retiring early and need temporary coverage until you are eligible for Medicare

- Getting divorced and no longer eligible for your spouse’s coverage

What’s the Price Difference between ACA Health Plans and Short-term Health Insurance in Florida?

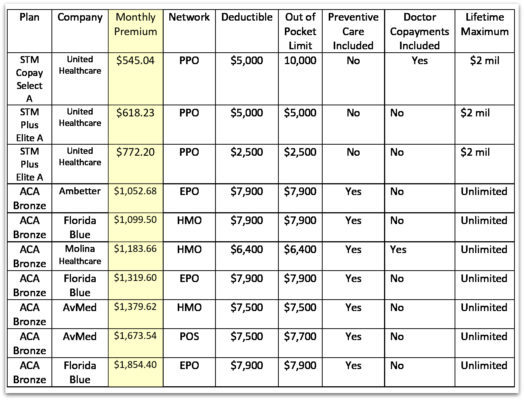

We have provided a comparison for your review to help you determine your savings on a Short-Term Health Insurance Policy in Florida from UnitedHealthcare versus other ACA compliant health insurance plans available for 2019.

We have previously presented the differences between Short-Term Health Insurance and the ACA approved policies. To compare these plans, please pay special attention to the deductibles, the coinsurance, and the monthly premiums. These policies were rated using a 40-year old married couple with two children, living in Broward County, Florida with a household income of $125,000. This family does not qualify for a subsidy.

Other Considerations

Do you remember when you were told: “If you like your doctor, you can keep your doctor?” Millions found out differently because their doctor was not a member of the ACA’s provider networks.

Do you remember when you were told: “If you like your plan, you can keep your plan?” Not long after that millions began receiving cancellation notices because the plan they had did not contain the 10 Essential benefits.

Short-Term Health plans in Florida are certainly not for everybody. But if you are tired of paying unrealistic premiums while you rarely use your insurance, a short-term health plan may make better financial sense for you and your family.

If you are young and healthy and only see a physician once or twice a year, does it make sense to pay $25,000+ a year for insurance coverage that you’ll likely never use? If your answer is no, click the button below to get your instant quote for Short-Term Health Insurance in Florida from UnitedHealthcare.