Final Expense Insurance which is often referred to as burial insurance or funeral insurance is a whole life policy that is designed to cover the expenses you leave your surviving loved ones. These expenses usually include the cost of your funeral and burial, unpaid medical bills, and unpaid nursing home costs. Of these expenses listed, your funeral is likely to be the most expensive and you certainly don’t want to pass this burden on to grieving loved ones. In this article, we will discuss $13,000 Final Expense Quotes.

How Much Final Expense Insurance Do I Need?

The amount of coverage you need will depend on your final wishes for your funeral and burial plus some additional coverage to take care of other lingering expenses that you do not want to pass on to your family. In today’s economy, the average cost of a funeral is between $10,000 and $12,000 but that amount can certainly get higher if your loved ones decide to send you off with all the bells and whistles that a funeral home has to offer.

You can certainly reduce your final expense needs by asking to be cremated and just having a memorial service at your church or at home. To determine how much you can expect to pay for a funeral in your area, we recommend a funeral planning website like Parting.com. This online service will assist you with planning a funeral and will list the appropriate costs involved based on where you live.

I have Life Insurance, why do I Need Final Expense Insurance?

If you are still working and you are 50 or older, you should not rely on the life insurance you have at work because unless you pass away while you are still employed, it’s unlikely you will have any coverage. The majority of employer-sponsored life insurance policies are not portable which means when you leave your policy will not follow you to a new job or into retirement.

If you have an individual insurance policy like term life insurance, you could easily outlive that coverage or if you renew it when you get much older the policy premium will likely become unaffordable. If you have an individual insurance policy that is permanent insurance, like whole life or universal life, make sure that there will be enough coverage to pay for your final expenses plus any other financial arrangements you want to be taken care of like paying off your debts and the mortgage.

Can’t I Just Pre-Pay my Funeral Expenses?

Yes, you can pre-pay and pre-arrange your funeral to relieve the stress that it might put on your surviving loved ones. Making funeral arrangements in advance is a wonderful act of love because you are taking the necessary steps to remove the stress that funeral arrangements can put on your surviving family members.

There are, however, some downsides to prepaying your funeral. If your plans change or you move out of the area, you may find that the funeral home in your new area will not honor the deal of the previous funeral home which could lead to a significant increase in prices. And even worse than that, what if the funeral home you selected goes out of business? You could possibly lose your money altogether.

Having final expense insurance gives you the flexibility and peace of mind knowing that there will be sufficient funds for your loved ones to take care of your funeral.

What kind of Insurance Policy is Used for Final Expense Insurance?

Although there are companies that use term insurance for final expense insurance, we recommend that you always use whole life insurance because it is permanent and you will not outlive your coverage. Whole Life insurance has the guarantees that you can depend on when the worst thing happens.

- The insurance company cannot cancel your policy unless you stop making payments.

- The insurance company cannot increase your monthly premium because you become seriously ill or have to live in a nursing home. Once your policy is issued, your premium will never change.

- Your policy will build cash value over time that you can access through policy loans if you should ever need fast cash because of an emergency.

How Much Does Final Expense Insurance Cost?

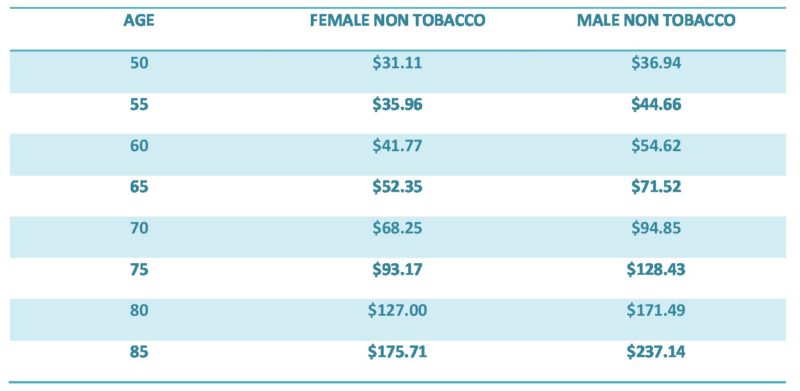

Your insurance cost will depend on your age and the amount of insurance you’d like to purchase. There will also be some health questions on the application but you won’t have to worry about a medical exam or blood tests. For the purposes of this article, we recommend that you buy $13,000 in coverage so that your beneficiary will have more than enough to pay your funeral expenses.

Here are Our $13,000 Final Expense Quotes

![]()

For an accurate quote for your actual age, please use our instant quote form on the right side of the page.

But what if I don’t Qualify?

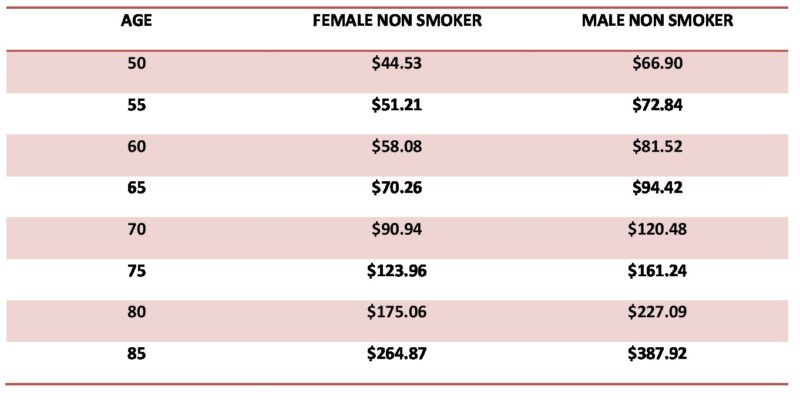

Regretfully not every applicant will qualify for the level benefit coverage used in the chart above. We do however have an alternative if you have health issues that are preventing you from buying traditional final expense insurance. Docktor’s Insurance represents multiple highly-rated insurance companies that offer “guaranteed issue” life insurance. These policies do not take any health issues into consideration and are typically always issued as long as you are within the age limit the company requires.

Here are actual $13,000 Final Expense Quotes for Guaranteed Issue Life Insurance.

It’s important to note that guaranteed issue life insurance policies have a two or three-year waiting period before they will pay the full benefit for a death from natural causes. If death is the result of an accident, the company will pay the full death benefit from the first day of coverage.