Although Final Expense insurance is not a technical name for a life insurance product, it is the purpose for what a life insurance policy is intended. With final expense insurance, we are talking about a whole life insurance policy whose death benefit is designated by the policyholder to pay for their “final expenses when the pass away.

The insurance policy you receive is not going to be stamped on the declarations page with the words “Final Expense Insurance,” so you will need to attach a note so that your beneficiary will note what the death benefit is for, especially if you have multiple life insurance policies.

What is Final Expense Insurance?

Final expense insurance is a life insurance policy that is purchased and then designated to pay the final expenses of the policyholder when they pass away. In most cases, the insured has already spoken to the named beneficiary about the existence of the policy and what to do with the death benefit. It’s important to understand, however, that unless the death benefit has been assigned to a particular funeral home or cremation service, the beneficiary can spend the money in any way they please.

Knowing this, it’s critical that the policyholder choose a beneficiary they can trust with carrying out their final wishes. The insurance company has no duty to make certain that the death benefit is spent in any particular manner, only to pay the benefit to the named beneficiary listed on the policy. For this reason, a policyholder should be diligent about changing beneficiaries when the need arises.

Generally, all final expense insurance policies are written using Whole Life Insurance because it is a permanent product and cannot be canceled by the insurer as long as the premiums are paid. This whole life policy will contain all of the guarantees and benefits of any other type of whole life policy and is a perfect way for funding the payment of final expenses.

What is Considered a Final Expense?

Most policyholders, who have purchased final expense insurance, have done so as an act of love for their surviving loved ones. Most will agree that the last thing you need to stress about when a loved one passes away is the cost of a funeral and memorial service.

There are other final expenses that can be included in your life insurance coverage. Lingering balances for medical services that weren’t paid by an insurance company or an outstanding balance owed to a nursing home. Most policyholders are not too concerned about debts unless they are transferable to a family member. All in all, your funeral and memorial service costs are going to be the bulk of your final expenses.

How Much Coverage Should I Buy?

Since funeral and burial costs represent the bulk of your final expenses, you should make certain that your death benefit is sufficient to cover the type of funeral you’d like your family to have for you.

Funeral expenses continue to rise as the cost of labor and products increase, and where you live geographically has an impact on the funeral cost as well. Fortunately there on services available online that can help you not only plan your funeral, but will also calculate how much you can expect to pay.

Parting.com is one of the more popular funeral arrangement websites, and they will provide you with the information you need to make an informed decision about your final wishes. In a recent article posted on their website, Parting.com indicated that funeral services are currently $8,000 to $10,000 depending on your location.

Knowing the costs of the funeral and burial service should help you determine at least the minimum death benefit to purchase. However, if you prefer cremation, your costs are typically cut in half. So then, if we figure the cost of an average funeral is between $8,000 and $10,000 and then add a couple thousand more for other final expenses, we can assume that a $12,000 Final Expense Insurance policy should suffice.

$12,000 Final Expense Quotes

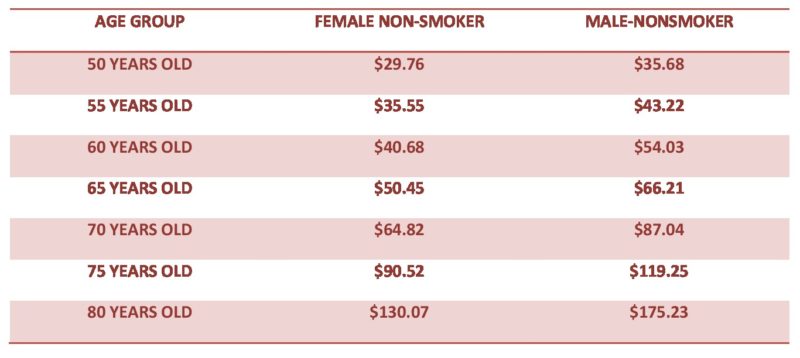

To help you determine your actual cost for a $12,000 Final Expense policy, we have listed actual quotes for a $12,000 Whole Life Final Expense insurance policy:

These rates are for level benefit coverage that provides first-day coverage and no medical exam is required. To get a quote for your actual age, please use our quote form on the right side of the page.

What If I don’t Qualify for Level Benefit Coverage?

The insurance companies who market life insurance products to seniors understand that health issues could disqualify a large amount of the marketplace from getting final expense insurance. For that reason, most companies will offer a “guaranteed issue” policy for applicants who do not qualify for traditional level benefit coverage. Although the rates are higher for guaranteed issue insurance, it is certainly better than having no life insurance to cover your final expenses.

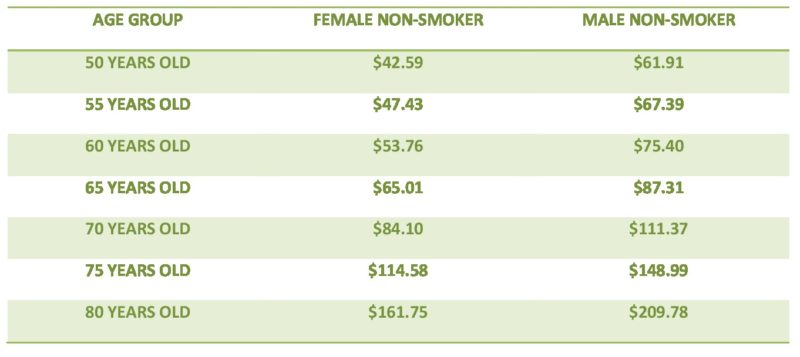

To help you determine your actual cost for a $12,000 Guaranteed Issue Final Expense policy, we have listed actual quotes for your review:

As you can see, the rates for guaranteed issue life insurance are substantially higher than those of a level benefit plan. Since the insurance company is accepting an unknown health risk, they must increase their rates to accommodate that individuals they are insuring are unhealthy and likely not to live as long as others without health issues.

The insurers will also have a waiting period (2 or 3 years) when they will not pay the full death benefit unless the policyholder’s death is the result of an accident.