As the name suggests, Final Expense Insurance is an insurance policy designed to pay for expenses related to a funeral, either traditional or cremation, and other expenses that might be left for surviving loved ones to pay for. The insurance policy is the funding vehicle that provides money for the beneficiary (surviving loved one) to pay all expenses associated with a memorial, funeral, burial and other expenses.

As the name suggests, Final Expense Insurance is an insurance policy designed to pay for expenses related to a funeral, either traditional or cremation, and other expenses that might be left for surviving loved ones to pay for. The insurance policy is the funding vehicle that provides money for the beneficiary (surviving loved one) to pay all expenses associated with a memorial, funeral, burial and other expenses.

What Type of Insurance Should I Purchase?

Although term insurance is cheaper to purchase, it’s typically not the best type of insurance to use for final expenses because it has an expiration date, no cash value, no living benefits, and the insured can outlive the coverage.

A better type of insurance to use for final expenses is whole life insurance. In fact, whole life insurance is the typical product used to fund most final expense policies because of the many benefits offered by the policy.

- Whole life is permanent insurance as long as the periodic premium is paid. It is guaranteed, cannot be canceled by the insurer (other than for non-payment), and the premium remains the same throughout the life of the policy.

- A whole life policy contains a cash value account that earns interest on a tax-deferred basis. The cash account can be accessed by the policyholder in the event of a financial emergency or any other reason the policyholder chooses.

- The policyholder is allowed to withdraw the accumulated cash via tax-free loans that do not have to be repaid (will be deducted from the death benefit), or by policy withdrawals or a partial or total surrender of the policy.

- A whole life policy that is used as funeral or final expense insurance, can be issued to applicants up to 85 years old.

- Many insurers offer “guaranteed issue” policies that do not require a medical exam or have medical questions on the application. These policies generally contain a two or three year waiting period before the full death benefit will be paid.

- Most insurers also offer a product known as “Simplified Whole Life.” This policy is similar to traditional Whole Life, but only includes medical questions about the applicant and no medical exam is required. It can be especially attractive for applicants who do not wish to undergo a medical exam.

How much Final Expense Insurance do I Need?

Your final expense insurance needs depend on the unpaid expenses you expect to leave when you die. The National Funeral Directors Association reports that a moderately priced traditional funeral will cost about $10,000 and cremation will cost about half as much.

Other expenses that should be considered are debts resulting from nursing home care, outstanding medical bills and other debts that you may want a surviving loved one to pay on your behalf.

Since your situation is likely to differ from others, contact an experienced and reputable insurance broker to discuss the various final expenses that you may want to deal with. Whether your needs are to cover just a funeral or other final expenses, your solution is more than likely to be found in a Final Expense Insurance policy.

How Much does Final Expense Insurance Cost?

Just like other life or health insurance products, the rates for a final expense insurance policy are based on the age and health of the applicant. Typically, when as applicant qualifies for level benefits with first-day coverage, the rates will be substantially lower than a graded benefit or guaranteed issue policy where there is a waiting period before the company will pay the full death benefit for death due to natural causes.

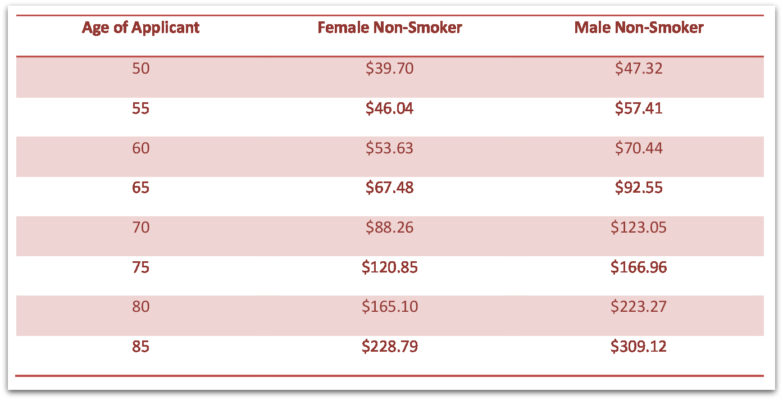

Here are the rates for $17,000 Final Expense Quotes with a Level Benefit:

This rate chart represents actual $17,000 Final Expense Quotes for Level Benefit and First-Day coverage policy. Please use our quote form on the right side of the page to get an accurate quote based on your actual age.

There are Alternatives if you don’t Qualify

If you’re shopping your Final Expense quotes with an independent insurance broker like Docktors Insurance, you can automatically apply for a guaranteed issue life insurance policy. A guaranteed issue insurance policy benefits those applicants who are unable to purchase traditional final expense insurance because of serious or multiple health issues.

The difference between level benefit (traditional) final expense coverage and guaranteed issue insurance coverage is as follows:

- Death Benefit – Insurance carriers usually limit the amount of coverage that can be purchased with a guaranteed issue policy. Face amounts are typically limited to $20,000.

- Waiting Period – A guaranteed issue policy will have a waiting period of two or three years when the full death benefit is reduced to the total premiums paid plus an additional 5 or 10% if the insured’s death is the result of natural causes. Once the waiting period has expired, the full death benefit will be paid for a death resulting from natural or accidental causes.

- Minimal Medical Underwriting – Since there literally no medical underwriting used when purchasing a guaranteed issue insurance policy, virtually any living person who qualifies by age will be issued a policy.

- Higher Rates – Since the insurance company is accepting an unknown medical risk, the insurance company is entitled to charge higher rates.

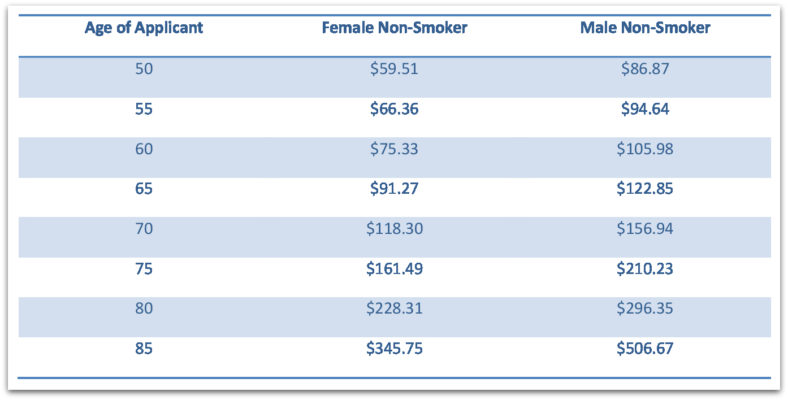

Here are the rates for $17,000 Final Expense Quotes that are Guaranteed Issue:

This chart represents $17,000 Final Expense Quotes with guaranteed issue coverage. For an accurate quote based on your actual age, please use our quote form to the right of this article.